Fraud Detection in Insurance Claim

Insurance Fraud is a huge problem in the Insurance Industry and it is very difficult to identify and detect fraudulent claims. In this Machine Learning model, RDA demonstrated how this ML predictive model can predict if an insurance claim is fraudulent or not. With this prediction data, we are able to estimate the total amount of predicted fraudulent is like.

A formal request to an insurance company for payment based on the provisions of the insurance policy is known as an insurance claim. Once the claim is granted, the insurance company examines it for authenticity before paying the insured or requesting party (on behalf of the insured).

Insurance fraud is a planned misrepresentation perform against or by an insurance company or agent for the purpose of financial gain. Applicants, policyholders, third-party claimants, and professionals that offer services to claims may all conduct fraud at different points in the transaction. Besides that, pad-ding, or inflating claims, misrepresenting facts on an insurance application, filing claims for injuries or damage that never happened, and staging accidents are all examples of common frauds.

As a result, the insurance sector urgently needs to create capabilities that can assist identify possible frauds with a high degree of accuracy, so that other claims may be processed quickly while the recog-nized instances are thoroughly investigated.

Why Machine Learning in Fraud Detection?

Fraud detection is one of the most important use cases in the insurance business, and AI may help to in-crease efficiency and value. Fraud costs in the insurance industry are billions of dollars every year. There are always signs that might imply a high-risk claimant, whether it’s hard fraud (e.g., staged accidents) or soft fraud (e.g., embezzlement). While these indicators are typically subtle, if they’re found, they can have a big beneficial influence on an insurer’s bottom line.

Auto Insurance Claim Fraud Detection

Auto insurance fraud includes all kinds of falsifying information on insurance applications to inflating in-surance claims, as well as staging incidents and filing claim forms for injuries or damage that never hap-pened, and fraudulent reports of stolen automobiles.

In this example, the RDA Data Science Team demonstrating the prediction results of the auto insurance data that can predict whether or not an insurance claim is false. In this machine learning model, we used Decision Tree as our binary classification task.

Machine Learning Model that leverage the power of DSS Dataiku Platform

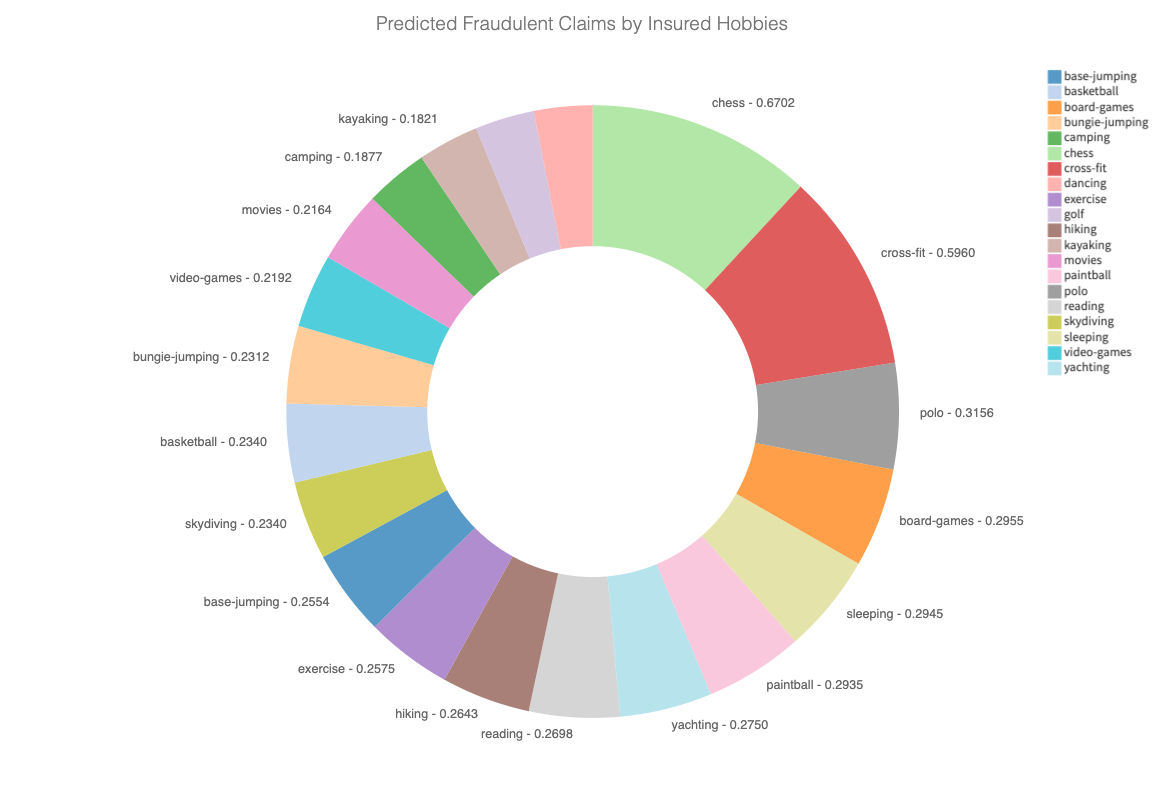

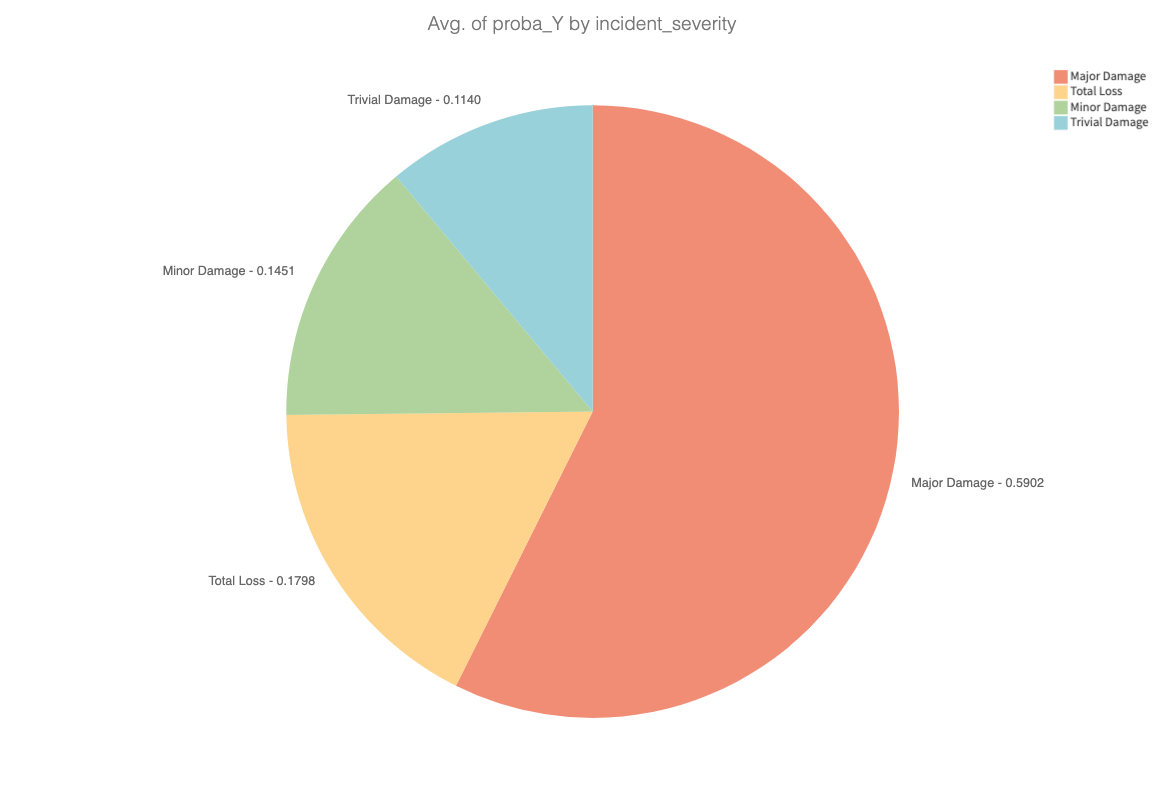

From the result of the prediction data, we are able to estimate the total pre-dicted fraudulent claim and zoom into the predicted fraud count by incident severity and insured hobbies are the best predictors for whether an insur-ance claim is fraudulent or not which is our model’s best predictor!

Based on the findings, we find out that people who are in major accidents and play chess or are into cross-fit are more prone to committing fraud.

Our Offering

RDA’s Data Science Team offers robust solutions to helps you facing the severe challenges in data quality that resulting in poor levels of prediction :

- We ensure that to provide a cost-effective suite for use in the area of insurance claim fraud

- We offer end-to-end machine learning techniques instantly to you that is industry prove

- We offer the best-tailored machine learning models for the specific business context and user priorities