Fraud Detection in Customer Transaction

The Covid-19 pandemic also contributed to the rising trend in fraud cases, as it accelerated the need for effective payment channels between consumers and companies – and faster payments can potentially mean faster crime. This ML Model demonstrated how to predict the probability that the online transaction is considered fraudulent based on the customer’s identity and history of the transaction.

Machine learning is used to identify fraud by evaluating existing customer habits and transaction techniques. It can evaluate these actions faster and more efficiently than a person could, allowing it can rapidly spot any deviations from typical behavior. This allows the user to approve a transaction in real-time before it can be completed.

Machine learning offers the added benefit of greater accuracy by eliminating human error in recording or analyzing data. Furthermore, machine learning models can handle large quantities of data, better predictions may be made. The more data to a model is given, the more it can learn from it and make even better predictions.

What is the Key Benefit of AI-Driven Fraud Prevention?

- It identifies emerging fraud to rapidly and correctly discover abnormalities and trends.

- It helps businesses accept more good orders, which improves sales and revenue.

- It reduces chargeback and manual review rates by lowering fraud operations expenses.

- It manages business results using goal-based risk thresholds that may be customized.

Key to a Successful Machine Learning Implementation in Fraud Detection

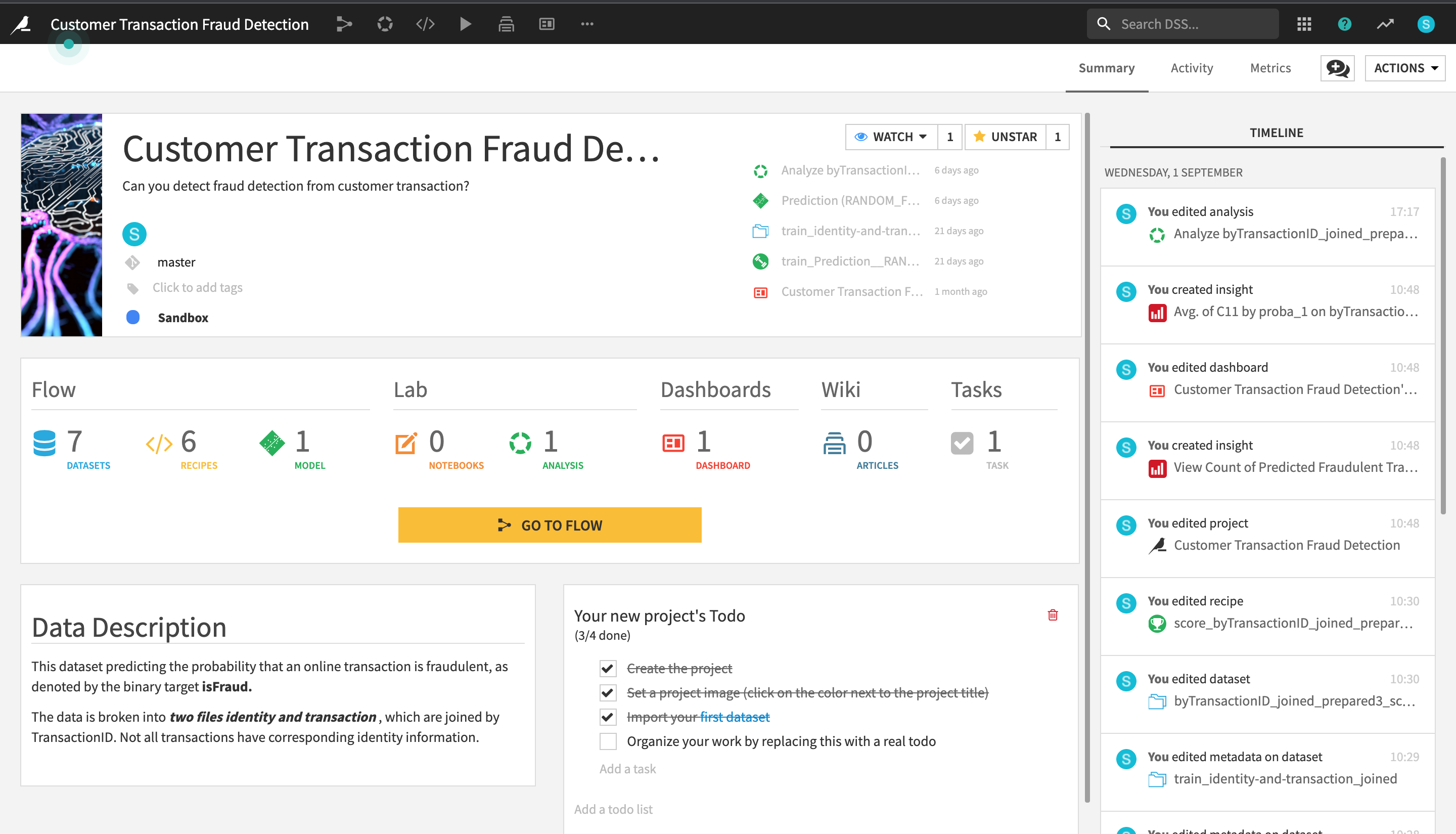

When used effectively, machine learning may save consumers and companies a significant amount of time and money. RDA’s Data Science Team developed a Machine Learning model to predict the probability that an online transaction is fraudulent, as denoted by the binary target “isFraud”.

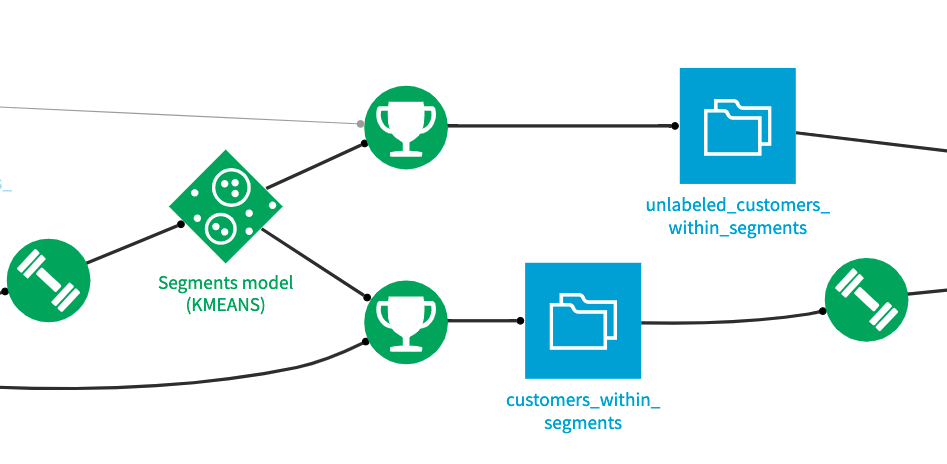

ML Workflow

RDA’s Data Science Team developed a supervised machine learning model that includes utilizing labeled historical data to train an algorithm. In this scenario, target variables have already been identified in current datasets, and the aim of the training is to teach the system to predict these variables in future data.

Our Offering

RDA’s Data Science Team offers you the best-tailored solutions that based suited to your industry but not limited to certain industries and domains. We ensure that your antifraud system meets the following standards:

- Detect Fraud in Real-Time

- Improve Data Credibility

- Analyze User Behaviour

- Uncover Hidden Correlations